Impact of Interest Rate Cuts on Real Estate Cap Rates

Source: CBRE

Now that the Fed is starting to cut interest rates, how will real estate capitalization rates react? Conditions that facilitate changes in short-term policy rates influence the long-end of the yield curve, which in turn most influences real estate investment activity.

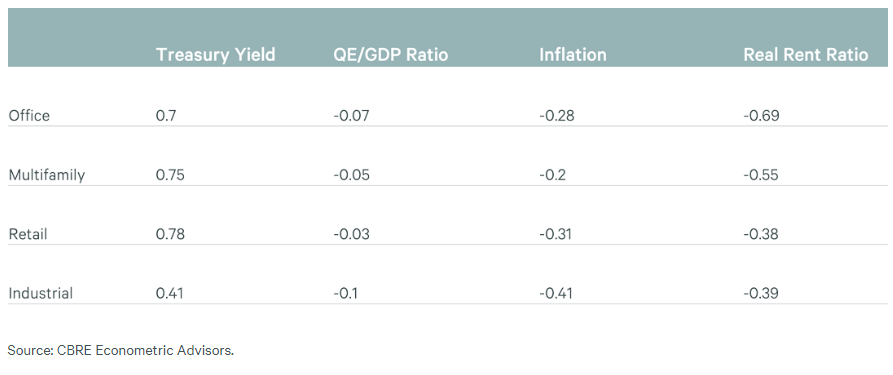

A CBRE Econometric Advisors (CBRE EA) review of cap rates since 1995 shows that for every 100-basis-point change in the 10-year Treasury yield, cap rate movements range between 41 basis points (bps) on average for industrial assets to 78 bps for retail assets. Office cap rate movements averaged 70 bps, while those for multifamily assets averaged 75 bps.

The fact that industrial assets were the least sensitive to long-term interest rates can likely be explained by the level of investor demand for logistics assets throughout the period. Prior to 2010, industrial assets were not in such high demand, leading to less cyclical cap rate compression. Following the COVID pandemic, however, strong fundamentals that supercharged demand for the sector kept industrial cap rates from climbing as much as those of other sectors. This structural shift in demand for industrial space boosted NOI growth and reduced risk premiums.

What moves cap rates?

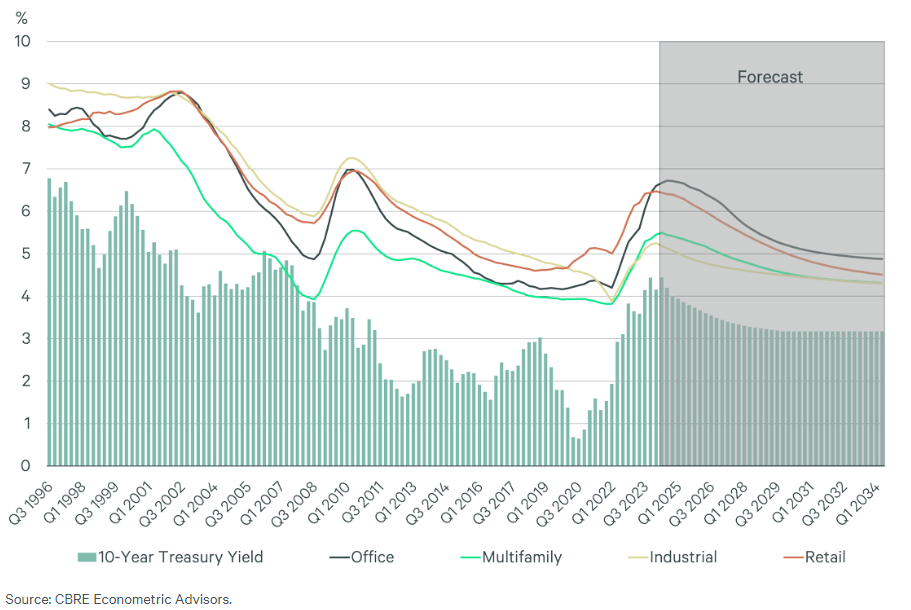

CBRE believes that the U.S. economy will avoid a recession as inflation continues to fall toward the Fed’s 2% target. We expect that the 10-year Treasury yield will average below 4% for the rest of 2024 and drift down to the mid-3% range in 2025. Treasury yields at that level will put downward pressure on cap rates as the lower cost of capital supports investment activity and asset values.

Additionally, this soft-landing scenario should support resilient commercial real estate fundamentals (excluding the office sector) that drive rent growth and returns from income, putting additional downward pressure on cap rates. Other factors that influence cap rates include the risk premium (yield spread vs. risk-free bonds), GDP, foreign exchange rates, inflation and the Fed balance sheet’s impact on market liquidity (Figures 1 and 2). Structural changes, such as the impact of remote working on the office sector, can have a great effect on cap rates.

Figure 1: Factors That Influence Cap Rates

Figure 2: Sensitivity of Cap Rates to Macro Factors

Broader Factors & What to Expect

While Treasury yields and rents have the most influence on cap rates, other significant factors include the risk premium and GDP growth. For example, the spread between cap rates and Treasury yields rises during economic slowdowns and declines during recoveries. CBRE EA forecasts that cap rates likely will fall more slowly than past cycles and stabilize at higher levels relative to pre-pandemic cap rates due to interest rates remaining above pre-pandemic levels. This is driven by outsized federal budget deficits and continued economic growth, among other factors.

Figure 3: Cap Rates & 10-Year Treasury Yields

We expect cap rates to begin compressing slowly in Q4 2024 and more noticeably in 2025. From their peaks to the end of 2025, we expect industrial cap rates to fall by 40 bps, retail by 35 bps, multifamily by 25 bps and office by 20 bps.

In the long term, we expect industrial and multifamily cap rates to stabilize at 4.5%, office cap rates at 5% and retail at 4.6%. All long-term stabilized cap rates will be higher than their pre-COVID levels.

Consequently, we recommend that investors consider broader macro drivers that influence Fed policy, rather than the speed or magnitude of the cuts themselves, to understand cap rate movements.

We’ve already started seeing some compression in multifamily and industrial cap rates and believe there will be notable variations both across and within various property types, even within the highly challenged office sector. Although macro factors determine the direction of cap rate movements, the extent of those movements can be influenced by the relative strength of each market and asset. Consequently, we think market and individual asset selection will be even more important considerations for investors during the current cycle.

You can access the original article here:Impact of Interest Rate Cuts on Real Estate Cap Rates